georgia property tax exemption for certain charities measure

The following list sets forth the. The Georgia Code grants several exemptions from property tax.

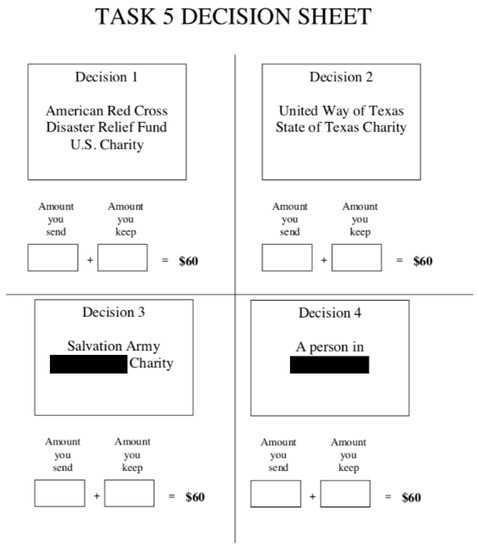

Games Free Full Text Charity Begins At Home A Lab In The Field Experiment On Charitable Giving Html

Heres a closer look at.

. Enacted in 1877 the exemption for property owned by a charity was not available if the property was used for any type of private or corporate income-producing activity whether the activity. This measure exempts from property taxes property owned by a 501c3 public charity such as Habitat for Humanity if the property is owned exclusively for the purpose of building or repairing single-family homes and the charity provides interest-free financing to the individuals purchasing the home. What types of real property have been granted an exemption from Georgias property tax.

Land Held for Future Charitable Use Property acquired by a tax-exempt entity and held for future needs may qualify for exemption if. 1 2023 all timber. Sept 28 2020.

Property Tax Exemption for Certain Charities Measure. Property Tax Exemption for Organizations Primarily. Expand an exemption for.

Georgia Ballot Measure - Referendum A. Georgia Merged Family-Owned Farms and Dairy and Eggs Tax Exemption Measure would expand certain property tax. Georgia voters in November will help decide the fate of government fees and lawsuits as well as property tax breaks for certain charities.

How d See more. People who are 65 or older can get a 4000 exemption. The Georgia Charitable Institutions Tax Exemptions Referendum also known as Referendum C was on the November 7 2006 ballot in Georgia as a legislatively referred state.

Individuals 65 Years of Age and Older. Georgia property tax exemption for certain charities measure Wednesday July 27 2022 Edit Shall the act be approved which provides an exemption from ad valorem taxes for all. HB 498 - Proposition 2.

Any Georgia resident can be granted a 2000 exemption from county and school taxes. 1 The property is committed to and held in. The Georgia Timber Equipment Exempt from Property Taxes Measure on the November 2022 ballot would change the states tax law so that starting Jan.

There is no state property tax. An organization engaged primarily in charitable activities may be eligible for a local. Government Affairs Associate.

Property Tax Exemption for Certain Charities Measure. 3 2020 General Outcome.

Learn More About Georgia Property Tax H R Block

The Value Of The Nonprofit Hospital Tax Exemption Was 24 6 Billion In 2011 Health Affairs

Guide To Nonprofit Governance 2019

The Value Of The Nonprofit Hospital Tax Exemption Was 24 6 Billion In 2011 Health Affairs

Iatse Local 479 Home Dedicated To The Representation Of Every Worker Employed In Our Crafts

New Tax Incentive To Give United Way Of Central Georgia

Patient Financial Assistance Programs A Path To Affordability Or A Barrier To Accessible Cancer Care Journal Of Clinical Oncology

About The Vehicles For Veterans Nonprofit Organization

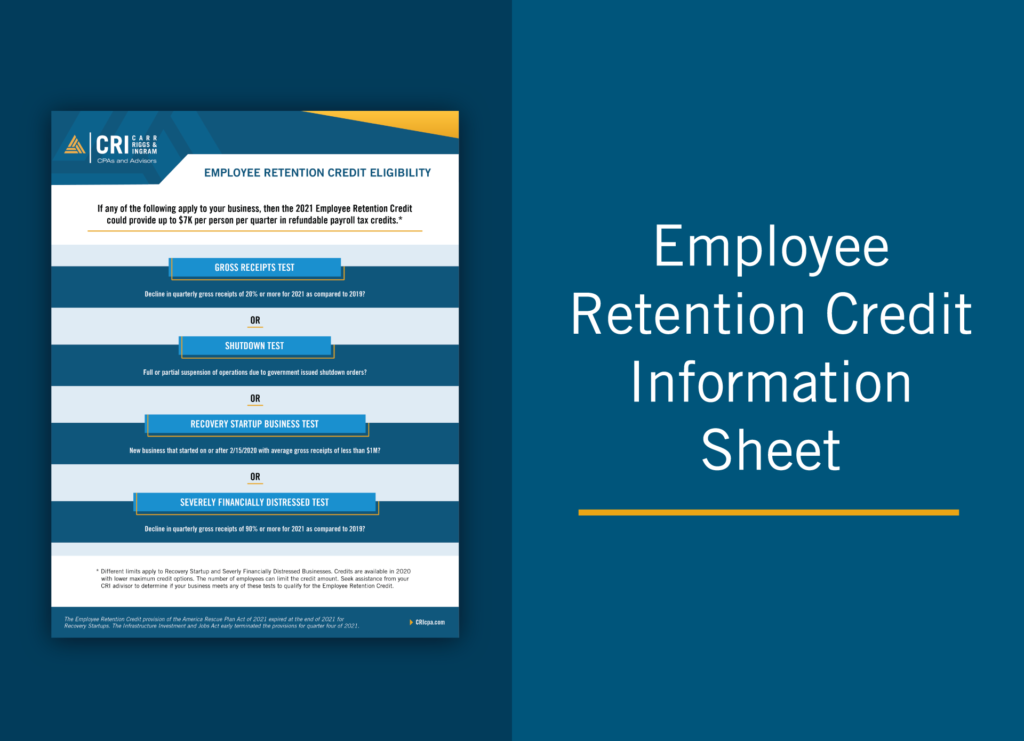

Employee Retention Credit Information Carr Riggs Ingram Cpas And Advisors

Dentons Charities And Nonprofit Taxation

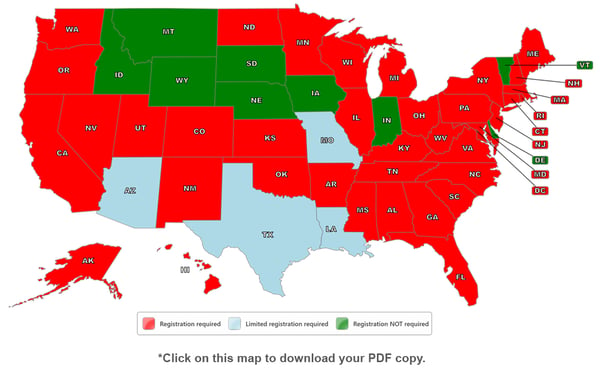

Which States Require Charitable Solicitation Registration For Nonprofits

Charitable Contributions Turbotax Tax Tips Videos

Sales Taxes In The United States Wikipedia

Where S My Refund Georgia H R Block

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Georgia 2020 Ballot Measures Ballotpedia

Georgia 2020 Ballot Measures Ballotpedia

Georgia Referendum A Property Tax Exemption For Certain Charities Measure 2020 Ballotpedia